A Newbie's Manual to Investing Overseas Futures: Unlocking International Opportunities

Wiki Article

Investing abroad futures offers investors the chance to engage in world wide marketplaces, diversify their portfolios, and faucet into prospects outside of their dwelling state. Whether or not you’re planning to hedge in opposition to dangers or speculate on cost actions, buying and selling futures on Worldwide exchanges can be an efficient technique. This article will take a look at what overseas futures are, how they function, and what you need to know to start out.

What exactly are Abroad Futures?

Overseas futures are standardized contracts traded on international exchanges, where the customer agrees to buy, and the vendor agrees to deliver, a specific asset in a predetermined cost with a foreseeable future day. These property can range between commodities like oil and gold to money instruments which include international indices or bonds. By buying and selling futures on global exchanges, traders can access a big range of marketplaces and obtain publicity to Worldwide financial trends.

How can Abroad Futures Trading Operate?

Picking out an International Trade: The initial step in investing overseas futures is to pick the suitable Trade. Well-liked Worldwide futures exchanges include things like the Tokyo Commodity Trade (TOCOM), Eurex in Europe, and also the Singapore Exchange (SGX). Just about every Trade features various futures contracts, so your decision will rely upon the marketplaces you’re thinking about.

Opening a Futures Trading Account: To trade overseas futures, you’ll must open a futures buying and selling account by using a broker that provides entry to Worldwide markets. Be sure the broker is dependable and features the mandatory instruments, investigate, and aid for investing on world wide exchanges.

Being familiar with Margin Prerequisites: Just like domestic futures investing, abroad futures generally have to have you to definitely deposit a margin—a fraction of the total deal benefit—as collateral. Margin necessities change depending on the Trade, the asset currently being traded, as well as the contract size.

Forex Factors: When investing futures on Global exchanges, forex fluctuations can impression your returns. You’ll must evaluate the exchange rate involving your house forex as well as the forex from the Trade. Some traders use forex hedging techniques to mitigate this hazard.

Market place Hours and Time Zones: Due to the fact overseas futures are traded on exchanges in numerous time zones, it’s imperative that you pay attention to the industry hours. This might require you to adjust your buying and selling program to align Using the opening hrs of Intercontinental marketplaces.

Settlement and Delivery: Futures contracts might be settled possibly through physical shipping and delivery of your asset or via funds settlement. Most retail traders select cash settlement, in which the distinction between the deal price and the market cost at expiration is paid out. Be certain to be aware of the settlement conditions of your contracts you’re trading.

Benefits of Investing Abroad Futures

World Diversification: Investing abroad futures helps you to diversify your portfolio by attaining publicity to distinctive economies, commodities, and economical devices throughout the world.

Usage of Rising Marketplaces: Worldwide futures exchanges supply entry to emerging marketplaces, that may give bigger advancement opportunity as compared to additional formulated markets.

Hedging Possibilities: Abroad futures can be employed to hedge in opposition to currency hazard, geopolitical situations, and various world-wide variables that might effects your investments.

Leveraged Buying and selling: Futures trading helps you to Regulate a big position with a comparatively little degree of money, thanks to leverage. This could certainly amplify your likely returns, although In addition it will increase hazard.

Pitfalls of Trading Overseas Futures

Forex Risk: Fluctuations in Trade rates can effect the worth of one's abroad futures contracts, leading to probable losses.

Regulatory Variations: Unique countries have various polices, which may have an impact on how futures contracts are traded and settled. It’s crucial to familiarize by yourself with The foundations of the exchange you’re buying and selling on.

Time Zone Troubles: Investing in numerous time zones might be hard, particularly when it demands you to monitor markets for the duration of non-typical several hours.

Market Volatility: International markets may be very unstable, and functions for instance political instability or financial downturns may result in sharp selling price actions.

Starting out with Overseas Futures Buying and selling

To begin trading abroad futures, start by researching Intercontinental marketplaces and determining the exchanges and contracts that align with the financial commitment aims. Open up a trading account having a broker that offers usage of these marketplaces, and make sure to familiarize your self with the precise procedures and necessities on the exchanges you’ll be trading on. Start compact and little by little enhance your exposure when you achieve expertise and confidence in the buying and selling strategy.

Summary

Overseas futures investing presents a novel chance for buyers to increase their horizons and faucet into world-wide marketplaces. Even though it comes with its individual set of troubles, the possible benefits may be considerable for those who make the effort to know the marketplaces, manage pitfalls effectively, and remain educated about international developments. By approaching overseas futures buying and selling with a well-assumed-out technique, you may unlock new avenues for development and diversification as part of your expense portfolio.

By educating by yourself over the intricacies of overseas futures trading, you can make knowledgeable selections and confidently navigate the complexities of the worldwide economical marketplaces.

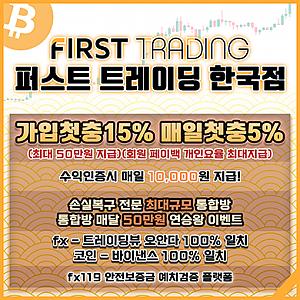

Learn more info. check out here: fx시티